Apparently Sheffield has big hopes. In fact, the city is hoping to become the UK’s very first self-sufficient energy city, according to UK energy minister Chris Huhne. On top of all of this, this deal has already been given Huhne’s full support.

While the energy minister was visiting the city, he stopped by the University of Sheffield. It is here where they are working on world leading research in sustainable technology. Overall, the goal is to come up with technology that can help a city become fully sustainable.

His visit to this city follows an announcement made by the Sheffield City Council and energy company E.ON. They have announced that they are working hard to form a city-wide partnership that will help the city produce enough renewable energy to become self-sufficient. Overtime, the long-term goal would be for the city to produce enough energy that it could even sell some excess energy back into the national grid.

So this brings up the question, why is E.ON choosing to partner with Sheffield over other cities. Apparently E.ON has chosen Sheffield because of its international expertise on developing renewable energy technology, pretty much meaning that E.ON has faith that Sheffield has the willpower to make such a scheme work.

This is a big deal in the making. The overall goal of the government would be to see other cities make these kind of deals with other energy companies. Overtime, all cities could become self-sufficient and, thus, would be able to supply their own energy. Then all of the excess energy that the UK makes could be sold to other countries.

Welcome to Wind trap Limited where we aim to save you energy by helping you generate you own energy by using wind turbines or solar PV panels while saving you energy with energy saving appliances and LED lights. We supply home users, farms, allotment societies, marine and classroom educational teaching aids for schools, colleges and universities.

Monday 28 February 2011

Friday 25 February 2011

Energetics and their relative market product position in comparison to the Ceramic Fuel Cell's Bluegen

Posted by ProperCharlie - 25 Feb'11 - 08:49

I wrote to CFU asking about Energetics and their relative market / product position. I thought you might be interested in this response I received,

"....Thank you for your note and your support for CFU.

A few points about Energetix and other mCHP products:

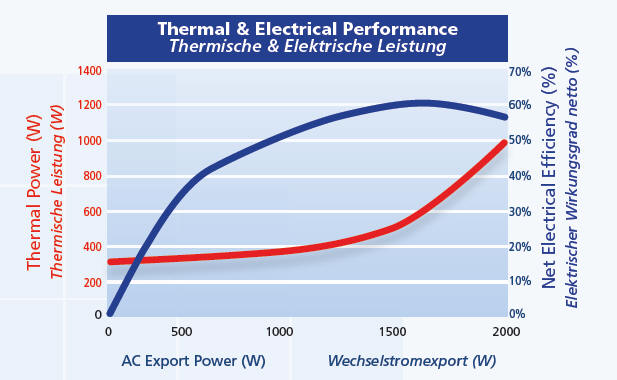

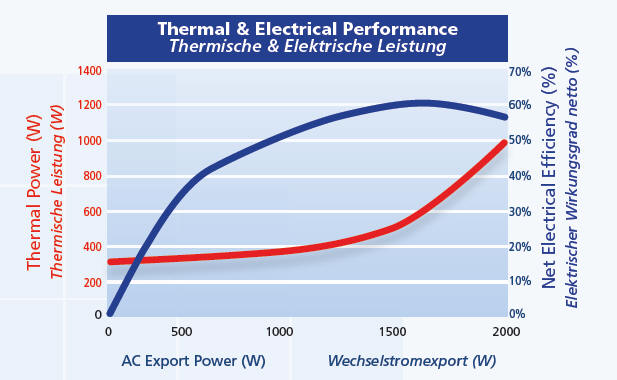

- Energetix and all other mCHP products are heaters that produce a small amount of power as a byproduct. BlueGen is the opposite - a mini power station with a small amount of heat. We think power is more valuable than heat, so maximise electrical efficiency. That's also the way to maximise carbon savings and energy bill savings.

- The key measure is electrical efficiency- other mCHP products are often less than 10% - BlueGen is >50%, peak of 60%- so they are very different offerings.

- There is plenty of room for a range of CHP technologies and products. They have different features/benefits and suit different types of buildings. It is not a binary choice - there will be fuel cells and other CHP products (not or). (Although of course we think we've got a compelling advantage through highest electrical efficiency....if you want a heater, buy a condensing boiler...)

- We think it's a good thing that EON and other large utilities are investing in a range of CHP products. It makes it more likely that they will actually deploy products in volume. It's a sensible approach to have a portfolio of products and customer offerings. Again, it's not a binary choice.

- The market is vast and we are in early sales. A range of low emissions technologies will be needed to quickly make large carbon cuts. Perhaps in a few years we will be competing for market share - but for now all mCHP products need to create the market, before we start dividing it!

PS if you need a 3rd party source for relative electrical efficiencies etc, UK Carbon Trust did a good report in late 2007 - summary attached, and also see http://www.carbontrust.co.uk/emerging-technologies/current-focus-areas/pages/micro-combined-heat-power.aspx. It's a bit dated now but will give you the key points.

Once again thanks for your support.

Regards

Andrew Neilson

Group General Manager - Commercial...."

I wrote to CFU asking about Energetics and their relative market / product position. I thought you might be interested in this response I received,

"....Thank you for your note and your support for CFU.

A few points about Energetix and other mCHP products:

- Energetix and all other mCHP products are heaters that produce a small amount of power as a byproduct. BlueGen is the opposite - a mini power station with a small amount of heat. We think power is more valuable than heat, so maximise electrical efficiency. That's also the way to maximise carbon savings and energy bill savings.

- The key measure is electrical efficiency- other mCHP products are often less than 10% - BlueGen is >50%, peak of 60%- so they are very different offerings.

- There is plenty of room for a range of CHP technologies and products. They have different features/benefits and suit different types of buildings. It is not a binary choice - there will be fuel cells and other CHP products (not or). (Although of course we think we've got a compelling advantage through highest electrical efficiency....if you want a heater, buy a condensing boiler...)

- We think it's a good thing that EON and other large utilities are investing in a range of CHP products. It makes it more likely that they will actually deploy products in volume. It's a sensible approach to have a portfolio of products and customer offerings. Again, it's not a binary choice.

- The market is vast and we are in early sales. A range of low emissions technologies will be needed to quickly make large carbon cuts. Perhaps in a few years we will be competing for market share - but for now all mCHP products need to create the market, before we start dividing it!

PS if you need a 3rd party source for relative electrical efficiencies etc, UK Carbon Trust did a good report in late 2007 - summary attached, and also see http://www.carbontrust.co.uk/emerging-technologies/current-focus-areas/pages/micro-combined-heat-power.aspx. It's a bit dated now but will give you the key points.

Once again thanks for your support.

Regards

Andrew Neilson

Group General Manager - Commercial...."

RNS 25 February 2011 Director Shareholding Ceramic Fuel Cells Limited

RNS Number : 8453B

Ceramic Fuel Cells Limited

25 February 2011

25 February 2011

Ceramic Fuel Cells Limited

Director Shareholding

Ceramic Fuel Cells Limited (AIM / ASX: CFU) announces that on 23 February 2011, Mr Roy Rose, a non-executive director of Ceramic Fuel Cells, via his superannuation fund (Holmwood Enterprises), purchased 100,000 ordinary shares in Ceramic Fuel Cells Limited ("Ordinary Shares") at a price of AUD 0.125, representing 0.00% of the issued share capital.

Following this announcement Mr Roy Rose is interested, directly or indirectly, in a total of 216,666 Ordinary Shares representing 0.00% of the issued share capital.

For further information please contact:

Ceramic Fuel Cells

Andrew Neilson Tel: +613 9554

2300

Email: investor@cfcl.com.au

Nomura Code Securities (AIM Tel: +44 (0) 207

Nomad) 776 1200

Juliet Thompson, Chris Golden www.nomuracode.com

About Ceramic Fuel Cells Limited:

Ceramic Fuel Cells Limited is a world leader in developing fuel cell technology to provide highly efficient and low-emission electricity from widely available natural gas. Ceramic Fuel Cells is developing fully integrated power and heating products with leading energy companies E.ON UK in the United Kingdom, GdF Suez in France and EWE in Germany. The company has sold BlueGen units to major utilities and other foundation customers in Germany, the United Kingdom, Switzerland, The Netherlands, Japan, Australia and the USA.

Ceramic Fuel Cells is listed on the London Stock Exchange AIM market and the Australian Securities Exchange (code CFU).

www.cfcl.com.au

This information is provided by RNS

The company news service from the London Stock Exchange

END

Ceramic Fuel Cells Limited

25 February 2011

25 February 2011

Ceramic Fuel Cells Limited

Director Shareholding

Ceramic Fuel Cells Limited (AIM / ASX: CFU) announces that on 23 February 2011, Mr Roy Rose, a non-executive director of Ceramic Fuel Cells, via his superannuation fund (Holmwood Enterprises), purchased 100,000 ordinary shares in Ceramic Fuel Cells Limited ("Ordinary Shares") at a price of AUD 0.125, representing 0.00% of the issued share capital.

Following this announcement Mr Roy Rose is interested, directly or indirectly, in a total of 216,666 Ordinary Shares representing 0.00% of the issued share capital.

For further information please contact:

Ceramic Fuel Cells

Andrew Neilson Tel: +613 9554

2300

Email: investor@cfcl.com.au

Nomura Code Securities (AIM Tel: +44 (0) 207

Nomad) 776 1200

Juliet Thompson, Chris Golden www.nomuracode.com

About Ceramic Fuel Cells Limited:

Ceramic Fuel Cells Limited is a world leader in developing fuel cell technology to provide highly efficient and low-emission electricity from widely available natural gas. Ceramic Fuel Cells is developing fully integrated power and heating products with leading energy companies E.ON UK in the United Kingdom, GdF Suez in France and EWE in Germany. The company has sold BlueGen units to major utilities and other foundation customers in Germany, the United Kingdom, Switzerland, The Netherlands, Japan, Australia and the USA.

Ceramic Fuel Cells is listed on the London Stock Exchange AIM market and the Australian Securities Exchange (code CFU).

www.cfcl.com.au

This information is provided by RNS

The company news service from the London Stock Exchange

END

Thursday 24 February 2011

Oil prices continue to rise. Is Peak-Oil time coming?

The world economy could be in for a massive shock as oil prices continue to rise.

Oil strategist at Nomura, Michael Lo, estimates that oil prices could top $220-a-barrel - almost double today's high of $119 - if both Libya and Algeria halt production as a result of political unrest.

He told The Daily Telegraph: "We could be underestimating this as speculative activities were largely not present in 1990-1991."

The oil price increases, coupled with such warnings, spell danger for economic recovery, as inflation feeds through the supply chain.

RMI Petrol, the body which represents fuel retailers, said prices demanded by wholesalers have risen "an unprecedented" 3p-a-litre so far this week and that increase is set to feed into pump prices by the weekend.

As it stands, the average price for a litre of unleaded is 128.9p, with diesel 134.3p.

The cost of filling up has soared as a result of higher oil and taxes

It is estimated that Libya's daily output of 1.6 million barrels has already been cut by more than half because of the uncertainty there.

Three major foreign producers, Eni, BASF and Winthershall, have turned off the taps.

Together they produce 450,000 barrels a day.

One of the largest tribes in eastern Libya has threatened to cut off exports from the port of Banghazi unless the violence against pro-democracy protesters stops.

Another tribe, based south of the capital Tripoli, has also turned against Colonel Muammar Gaddafi's regime.

Saudi Arabia has said it could produce an extra four million barrels a day to make up any lost capacity and help keep prices stable.

But that has done nothing to stop the speculators and limit the sense of market panic.

The political unrest is already hitting oil deliveries

The biggest fear is that the turmoil could spread across the Middle East and North Africa, which together produce a third of the world's oil.

RMI Petrol chairman Brian Madderson told Sky News: "RMI Petrol predicts that rises will filter through to petrol forecourts over the next few weeks, leading to an estimated 5p per litre increase by April 1."

He has called for April's planned fuel duty increase to be frozen and for the Government to introduce structures so duty falls when oil prices rise.

Chancellor George Osborne has said he is considering a fuel duty stabliliser.

Oil strategist at Nomura, Michael Lo, estimates that oil prices could top $220-a-barrel - almost double today's high of $119 - if both Libya and Algeria halt production as a result of political unrest.

He told The Daily Telegraph: "We could be underestimating this as speculative activities were largely not present in 1990-1991."

The oil price increases, coupled with such warnings, spell danger for economic recovery, as inflation feeds through the supply chain.

RMI Petrol, the body which represents fuel retailers, said prices demanded by wholesalers have risen "an unprecedented" 3p-a-litre so far this week and that increase is set to feed into pump prices by the weekend.

As it stands, the average price for a litre of unleaded is 128.9p, with diesel 134.3p.

The cost of filling up has soared as a result of higher oil and taxes

It is estimated that Libya's daily output of 1.6 million barrels has already been cut by more than half because of the uncertainty there.

Three major foreign producers, Eni, BASF and Winthershall, have turned off the taps.

Together they produce 450,000 barrels a day.

One of the largest tribes in eastern Libya has threatened to cut off exports from the port of Banghazi unless the violence against pro-democracy protesters stops.

Another tribe, based south of the capital Tripoli, has also turned against Colonel Muammar Gaddafi's regime.

Saudi Arabia has said it could produce an extra four million barrels a day to make up any lost capacity and help keep prices stable.

But that has done nothing to stop the speculators and limit the sense of market panic.

The political unrest is already hitting oil deliveries

The biggest fear is that the turmoil could spread across the Middle East and North Africa, which together produce a third of the world's oil.

RMI Petrol chairman Brian Madderson told Sky News: "RMI Petrol predicts that rises will filter through to petrol forecourts over the next few weeks, leading to an estimated 5p per litre increase by April 1."

He has called for April's planned fuel duty increase to be frozen and for the Government to introduce structures so duty falls when oil prices rise.

Chancellor George Osborne has said he is considering a fuel duty stabliliser.

British Gas profits rose by 24% to a record £742m last year

British Gas has ignited customer criticism after reporting its profits rose by 24% to a record £742m last year.

The announcement was made two months after the company raised prices by 7%, during the worst winter in a century.

Around eight million British Gas customers were affected by the December 10 increase, and saw their average annual bills rise from £1,157 to £1,239.

Adam Scorer of Consumer Focus told Sky News: "Millions of households are suffering from fuel poverty which is when 10% of their income goes on the cost of keeping warm and powering the lights."

"I think when consumers see the size of these profits you can expect them to be somewhere on the spectrum from very frustrated to outraged."

Centrica Share Price 1-Year Chart

Sam Laidlaw, chief executive of Centrica - which owns British Gas - said the energy industry was in a volatile situation with commodity prices, but his company would do all it could to keep bills as low as possible.

He said British Gas would help reduce bills by providing free loft or cavity insulation to customers who buy its electricity as well as its gas.

But speaking to Sky News, British Gas' managing director Phil Bentley seemed to open up the offer to all customers - not just those who were "first in, first served".

But a company spokesman later clarified his comments by saying any customer could apply for free loft or cavity wall insulation as long as they did so online before the end of May.

British Gas is part of the energy giant Centrica

The offer was also limited to 200,000 households, the company said.

British Gas added 270,000 customers last year and is the UK's biggest gas supplier with 16 million customer accounts.

It is owned by energy giant Centrica which also revealed record figures, with its operating profits up by 29% at £2.4bn.

Centrica says recent prices increases were down to soaring wholesale prices.

The company also claims British Gas prices were 0.5% lower at the end of 2010 than at the start of the year after the supplier cut bills by 7% in February.

Ofgem, the energy watchdog, is leading an investigation into the energy giants' balance sheets after discovering average profit margins had increased as companies claimed they had no choice but to lift bills.

The announcement was made two months after the company raised prices by 7%, during the worst winter in a century.

Around eight million British Gas customers were affected by the December 10 increase, and saw their average annual bills rise from £1,157 to £1,239.

Adam Scorer of Consumer Focus told Sky News: "Millions of households are suffering from fuel poverty which is when 10% of their income goes on the cost of keeping warm and powering the lights."

"I think when consumers see the size of these profits you can expect them to be somewhere on the spectrum from very frustrated to outraged."

Centrica Share Price 1-Year Chart

Sam Laidlaw, chief executive of Centrica - which owns British Gas - said the energy industry was in a volatile situation with commodity prices, but his company would do all it could to keep bills as low as possible.

He said British Gas would help reduce bills by providing free loft or cavity insulation to customers who buy its electricity as well as its gas.

But speaking to Sky News, British Gas' managing director Phil Bentley seemed to open up the offer to all customers - not just those who were "first in, first served".

But a company spokesman later clarified his comments by saying any customer could apply for free loft or cavity wall insulation as long as they did so online before the end of May.

British Gas is part of the energy giant Centrica

The offer was also limited to 200,000 households, the company said.

British Gas added 270,000 customers last year and is the UK's biggest gas supplier with 16 million customer accounts.

It is owned by energy giant Centrica which also revealed record figures, with its operating profits up by 29% at £2.4bn.

Centrica says recent prices increases were down to soaring wholesale prices.

The company also claims British Gas prices were 0.5% lower at the end of 2010 than at the start of the year after the supplier cut bills by 7% in February.

Ofgem, the energy watchdog, is leading an investigation into the energy giants' balance sheets after discovering average profit margins had increased as companies claimed they had no choice but to lift bills.

Solar panel has world's highest energy conversion efficiency rate of 21.6 percent

A manufacturer of what is believed to be the world's most efficient solar units announced on February 1 that the cells have achieved MCS accreditation and are now ready for use in the UK.

SANYO Component Europe GmbH (SANYO) produces the HIT series of photovoltaic cells, including the N 220SE10 which, to date, has the world's highest energy conversion efficiency rate of 21.6 percent.

On February 1 the company announced that the HIT cells had passed MCS accreditation. MCS accreditation is bestowed upon companies by the independent Microgeneration Certification Scheme, which certifies small scale or 'mircogeneration' technologies that are used to produce heat of electricity from renewable resources.

Though the HIT Series of cells are already commercially available throughout mainland Europe, MCS accreditation is required before products can be released into the UK market.

For consumers the MCS accreditation essentially means that consumers can use the HIT cells under the Feed In Tariff (FIT) scheme - a Europe-wide financial incentive rewarding those who install power generating renewable energy devices connected to the grid.

This is of benefit to consumers as the high efficiency rate allows more power to be generated using fewer cells and also means that less roof space is required to generate solar power- which increases the opportunities for renewable energy generation for those where space is an issue. The 'N' series of HIT modules will be commercially available from March 2011.

Other renewable energy companies from around the world will be showcasing the latest in renewable and energy efficient technologies at a series of upcoming exhibitions including), EXPO Solar in Goyang, South Korea (February 16-18), the Renewable Energy Expo in Lyon, France (February15-18) and Eco Build in London (March 1-3).

Eco Build attracts over 1,300 exhibitors and 41,000 visitors from around the globe and is used by companies as a launchpad for their new products. At Eco Build 2011 numerous photovoltaic companies including Emmvee, the Ideal Group and Mitsubishi plan to launch their latest innovations in the field of solar power.

SANYO Component Europe GmbH (SANYO) produces the HIT series of photovoltaic cells, including the N 220SE10 which, to date, has the world's highest energy conversion efficiency rate of 21.6 percent.

On February 1 the company announced that the HIT cells had passed MCS accreditation. MCS accreditation is bestowed upon companies by the independent Microgeneration Certification Scheme, which certifies small scale or 'mircogeneration' technologies that are used to produce heat of electricity from renewable resources.

Though the HIT Series of cells are already commercially available throughout mainland Europe, MCS accreditation is required before products can be released into the UK market.

For consumers the MCS accreditation essentially means that consumers can use the HIT cells under the Feed In Tariff (FIT) scheme - a Europe-wide financial incentive rewarding those who install power generating renewable energy devices connected to the grid.

This is of benefit to consumers as the high efficiency rate allows more power to be generated using fewer cells and also means that less roof space is required to generate solar power- which increases the opportunities for renewable energy generation for those where space is an issue. The 'N' series of HIT modules will be commercially available from March 2011.

Other renewable energy companies from around the world will be showcasing the latest in renewable and energy efficient technologies at a series of upcoming exhibitions including), EXPO Solar in Goyang, South Korea (February 16-18), the Renewable Energy Expo in Lyon, France (February15-18) and Eco Build in London (March 1-3).

Eco Build attracts over 1,300 exhibitors and 41,000 visitors from around the globe and is used by companies as a launchpad for their new products. At Eco Build 2011 numerous photovoltaic companies including Emmvee, the Ideal Group and Mitsubishi plan to launch their latest innovations in the field of solar power.

Energy provider E.ON has won the exclusive right to explore land owned by Forestry Commission Scotland

Energy provider E.ON has won the exclusive right to explore the potential for new wind energy projects on two lots of land owned by Forestry Commission Scotland (FCS).

E.ON estimates that the two awarded lots located in the north and west of Scotland have the potential to generate around 500MW or enough renewable electricity to power more than 270,000 homes annually, based on an average annual domestic household consumption of 4,700kWh.

Read more: http://www.theengineer.co.uk/sectors/energy-and-environment/eon-wins-right-to-develop-wind-energy-on-scottish-lots/1007546.article#ixzz1EsshhoSV

E.ON estimates that the two awarded lots located in the north and west of Scotland have the potential to generate around 500MW or enough renewable electricity to power more than 270,000 homes annually, based on an average annual domestic household consumption of 4,700kWh.

Read more: http://www.theengineer.co.uk/sectors/energy-and-environment/eon-wins-right-to-develop-wind-energy-on-scottish-lots/1007546.article#ixzz1EsshhoSV

E.ON has been named one of the 100 best employers in Germany.

E.ON has been named one of the 100 best employers in Germany. E.ON also achieved an excellent 5th place postion in the category "Companies with over 5,000 employees" in the coveted Great Place to Work® Institute "Deutschlands Beste Arbeitgeber 2011" awards. This is the 8 time E.ON, one of the largest power and gas companies in Europe, has been successful. The award recognizes attractive employers with a special quality and was conferred by the Great Place to Work® Institute Germany and the Federal Ministry of Labour and Social Affairs at an award gala in Berlin.

Regine Stachelhaus, member of the E.ON AG Board of Management said: "Our ranking among the top 5 employers in Germany is an award for our HR work. We will not let up in our commitment to create attractive working conditions and development possibilities in order to offer our employees a rewarding working environment and, in an increasingly tighter market, to continue to remain among the best for recruiting talent."

As part of the nationwide employer competition, seven German E.ON companies participated in an anonymous employee survey. The key assessment criteria were credibility, respect and fairness, identification of the employees with and the team spirit in the company. In addition, the activities and concepts of the company’s HR work were analysed and assessed in a ‘culture audit’.

A total of 290 companies from all branches of industry, size categories and regions applied for the quality seal " Deutschlands Beste Arbeitgeber 2011". They were subjected to a thorough examination and an independent assessment of their quality and attraction as employers. The Great Place to Work® Institute Germany surveyed a total of some 120,000 workers.

The annual study and the competition " Deutschlands Beste Arbeitgeber" are conducted by the Great Place to Work® Institute Germany in cooperation with the New Quality of Work Initiative (INQA), the University of Cologne and the Federal Ministry of Labour and Social Affairs. The "Handelsblatt" newspaper and "personalmagazin" are the media partners.

Regine Stachelhaus, member of the E.ON AG Board of Management said: "Our ranking among the top 5 employers in Germany is an award for our HR work. We will not let up in our commitment to create attractive working conditions and development possibilities in order to offer our employees a rewarding working environment and, in an increasingly tighter market, to continue to remain among the best for recruiting talent."

As part of the nationwide employer competition, seven German E.ON companies participated in an anonymous employee survey. The key assessment criteria were credibility, respect and fairness, identification of the employees with and the team spirit in the company. In addition, the activities and concepts of the company’s HR work were analysed and assessed in a ‘culture audit’.

A total of 290 companies from all branches of industry, size categories and regions applied for the quality seal " Deutschlands Beste Arbeitgeber 2011". They were subjected to a thorough examination and an independent assessment of their quality and attraction as employers. The Great Place to Work® Institute Germany surveyed a total of some 120,000 workers.

The annual study and the competition " Deutschlands Beste Arbeitgeber" are conducted by the Great Place to Work® Institute Germany in cooperation with the New Quality of Work Initiative (INQA), the University of Cologne and the Federal Ministry of Labour and Social Affairs. The "Handelsblatt" newspaper and "personalmagazin" are the media partners.

Labels:

100,

best,

board,

Deutschland,

e.on,

electric,

electricity,

elektrischen,

employers,

gas,

germany,

hr,

labour,

power

Ceramic Fuel Cells Limited Director Shareholding 24 February 2011

24 February 2011

Ceramic Fuel Cells Limited

Director Shareholding

Ceramic Fuel Cells Limited (AIM / ASX: CFU) announces that on 23 February 2011, Mr John Dempsey, a non-executive director of Ceramic Fuel Cells, via his superannuation fund (JHM Superfund), purchased 100,000 ordinary shares in Ceramic Fuel Cells Limited ("Ordinary Shares") at a price of AUD 0.125, representing 0.00% of the issued share capital.

Following this announcement Mr John Dempsey is interested, directly or indirectly, in a total of 400,000 Ordinary Shares representing 0.00% of the issued share capital.

For further information please contact:

Ceramic Fuel Cells

Andrew Neilson Tel: +613 9554

2300

Email: investor@cfcl.com.au

Ceramic Fuel Cells Limited

Director Shareholding

Ceramic Fuel Cells Limited (AIM / ASX: CFU) announces that on 23 February 2011, Mr John Dempsey, a non-executive director of Ceramic Fuel Cells, via his superannuation fund (JHM Superfund), purchased 100,000 ordinary shares in Ceramic Fuel Cells Limited ("Ordinary Shares") at a price of AUD 0.125, representing 0.00% of the issued share capital.

Following this announcement Mr John Dempsey is interested, directly or indirectly, in a total of 400,000 Ordinary Shares representing 0.00% of the issued share capital.

For further information please contact:

Ceramic Fuel Cells

Andrew Neilson Tel: +613 9554

2300

Email: investor@cfcl.com.au

Labels:

2011,

24,

Cells,

Ceramic,

Director,

february,

Fuel,

John Dempsey,

Limited,

Shareholding

Wednesday 23 February 2011

Mitsubishi Electric Corp. has installed an 85 kW photovoltaic system on the roof of Makita Corp.'s main factory in Takamatsu City, Japan

Mitsubishi Electric Corp. has installed an 85 kW photovoltaic system on the roof of Makita Corp.'s main factory in Takamatsu City, Japan.

The PV system, which is the first for Makita, will begin generating electricity later this month, according to Mitsubishi Electric. Electricity generated by a total of 448 PV modules installed over a surface area of 700 square meters will cover approximately 3% of the manufacturing, air conditioning and lighting requirements at Makita's marine diesel engine factory.

SOURCE: Mitsubishi Electric

The PV system, which is the first for Makita, will begin generating electricity later this month, according to Mitsubishi Electric. Electricity generated by a total of 448 PV modules installed over a surface area of 700 square meters will cover approximately 3% of the manufacturing, air conditioning and lighting requirements at Makita's marine diesel engine factory.

SOURCE: Mitsubishi Electric

Labels:

air conditioning,

electric,

factory,

installed,

japan,

Makita,

marine,

mitsubishi,

panels,

photovoltaic,

pv,

roof,

solar,

system

Arab Islamic Bank in Irbid has Multi V Systems, the latest commercial air conditioning innovation from LG air conditioning

Multi V Systems, the latest commercial air conditioning innovation from LG Electronics, to be installed at the Arab Islamic Bank in Irbid, according to an agreement recently signed by Shami & Hyari Engineering & Contracting Co., the complex construction company, and Al-Asalah Electromechanics Co, LG commercial air conditioning agent in Jordan. This fruitful cooperation is part of LG's strategy to expand in the central air conditioning market, especially in systems that better serve the commercial sector, in addition to its keenness to provide products of latest techniques and the highest international quality standards.

GM of Al-Asalah Co., Mr. Issam Samara, and Eng. Ammar Shami, representing Shami & Hyari Co., signed the agreement in presence of the Marketing and Sales Manager, Mr. Hammam Al-Mubaiad, and the Engineering Department Manager, Eng. Iyad Al-Haj from Al-Asalah.

During the signing ceremony, Mr. Samara extended his gratitude to the project's contractors, Al Shami & Hyari Construction Co., the project's consultants, Dumiati and Sha'sha'a engineering office, and to the Arab Islamic Bank. He further pledged to offer better after sale services, through Al-Asalah technical and engineering team who regularly follow up on LG HVAC systems.

LG MULTI V air conditioning systems are perfect for high-rise buildings- up to 100m- with a flair for style. LG MULTI V ART COOLTM inverter is one of the world's largest-capacity units, amounting 64 horse power per unit; it boosts an ultra-efficient VRF system, and the highest level of customer satisfaction with four external units and high quality compressors running by "Inverter" technique which reduces electricity consumption.

This system is also marked for its flexible design, it can operate 64 interior units of different sizes and shapes; not to forget to mention the smooth performance, various operation speeds, the quality air purifying filters and air conditioning switches to maintain the optimum room temperature during the most challenging season changes that can reach to 54c degree in summer and 20c in winter.

GM of Al-Asalah Co., Mr. Issam Samara, and Eng. Ammar Shami, representing Shami & Hyari Co., signed the agreement in presence of the Marketing and Sales Manager, Mr. Hammam Al-Mubaiad, and the Engineering Department Manager, Eng. Iyad Al-Haj from Al-Asalah.

During the signing ceremony, Mr. Samara extended his gratitude to the project's contractors, Al Shami & Hyari Construction Co., the project's consultants, Dumiati and Sha'sha'a engineering office, and to the Arab Islamic Bank. He further pledged to offer better after sale services, through Al-Asalah technical and engineering team who regularly follow up on LG HVAC systems.

LG MULTI V air conditioning systems are perfect for high-rise buildings- up to 100m- with a flair for style. LG MULTI V ART COOLTM inverter is one of the world's largest-capacity units, amounting 64 horse power per unit; it boosts an ultra-efficient VRF system, and the highest level of customer satisfaction with four external units and high quality compressors running by "Inverter" technique which reduces electricity consumption.

This system is also marked for its flexible design, it can operate 64 interior units of different sizes and shapes; not to forget to mention the smooth performance, various operation speeds, the quality air purifying filters and air conditioning switches to maintain the optimum room temperature during the most challenging season changes that can reach to 54c degree in summer and 20c in winter.

Ceramic Fuel Cells Limited Ceramic Fuel Cells to exhibit at Ecobuild 2011

Ceramic Fuel Cells Limited Ceramic Fuel Cells to exhibit at Ecobuild

London Stock Exchange Aggregated Regulatory News Service (ARNS)

February 23, 2011

RNS Number : 6850B Ceramic Fuel Cells Limited 23 February 2011 23 February 2011 Ceramic Fuel Cells to exhibit BlueGen gas-to-electricity generator at E.ON's stand at Ecobuild Ceramic Fuel Cells Limited [AIM/ASX:CFU], a leading developer of high efficiency and low emission electricity generation units for homes and other buildings, is to exhibit its BlueGen gas-to-electricity generator at E.ON's stand at the forthcoming Ecobuild trade show.

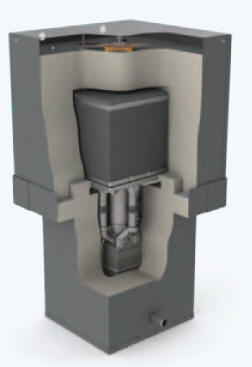

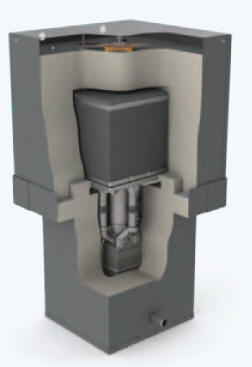

This is the first time that BlueGen has been made available for public viewing in the UK. BlueGen uses ceramic fuel cells to turn natural gas into electricity and heat for hot water. BlueGen units can generate electricity far more efficiently than the current power grid, providing significant cost savings to energy bills and large carbon savings. Ecobuild, which is to be held at the ExCeL exhibition and conference centre in the London's Docklands from 1 March to 3 March 2011, is the world's biggest event for sustainable design, construction and the built environment and the UK's largest construction event of any kind. On 22 December 2010 Ceramic Fuel Cells Limited announced that it had sold three BlueGen gas-to-electricity generators to E.ON, one of the UK's leading energy companies and that the two companies are continuing to develop fully integrated power and heating products for the UK market. Investors or media interested in learning more about BlueGen or receiving a demonstration at Ecobuild should contact Ceramic Fuel Cells Limited. www.ecobuild.co.uk/index.html Ceramic Fuel Cells Limited Mark Way +44 7786 116991 About Ceramic Fuel Cells Limited: -- Ceramic Fuel Cells Limited is a world leader in developing fuel cell technology to provide highly efficient and low-emission electricity from widely available natural gas. -- Ceramic Fuel Cells is developing fully integrated power and heating products with leading energy companies E.ON UK in the United Kingdom, GdF Suez in France and EWE in Germany. -- During 2010 EWE placed a conditional order for up to 200 integrated micro CHP products Ceramic Fuel Cells' patented technology. -- Ceramic Fuel Cells Limited has also sold 55 BlueGen gas-to-electricity generators to major utilities and other foundation customers in Germany, the United Kingdom, Switzerland, The Netherlands, Japan, Australia and the USA. -- Ceramic Fuel Cells is listed on the London Stock Exchange AIM market and the Australian Securities Exchange (code CFU). www.cfcl.com.au About E.ON: -- E.ON is one of the UK's leading power and gas companies - generating and distributing electricity, and retailing power and gas - and is part of the E.ON group, one of the world's largest investor-owned power and gas companies. E.ON employs more than 15,000 people in the UK and more than 88,000 worldwide.

London Stock Exchange Aggregated Regulatory News Service (ARNS)

February 23, 2011

RNS Number : 6850B Ceramic Fuel Cells Limited 23 February 2011 23 February 2011 Ceramic Fuel Cells to exhibit BlueGen gas-to-electricity generator at E.ON's stand at Ecobuild Ceramic Fuel Cells Limited [AIM/ASX:CFU], a leading developer of high efficiency and low emission electricity generation units for homes and other buildings, is to exhibit its BlueGen gas-to-electricity generator at E.ON's stand at the forthcoming Ecobuild trade show.

This is the first time that BlueGen has been made available for public viewing in the UK. BlueGen uses ceramic fuel cells to turn natural gas into electricity and heat for hot water. BlueGen units can generate electricity far more efficiently than the current power grid, providing significant cost savings to energy bills and large carbon savings. Ecobuild, which is to be held at the ExCeL exhibition and conference centre in the London's Docklands from 1 March to 3 March 2011, is the world's biggest event for sustainable design, construction and the built environment and the UK's largest construction event of any kind. On 22 December 2010 Ceramic Fuel Cells Limited announced that it had sold three BlueGen gas-to-electricity generators to E.ON, one of the UK's leading energy companies and that the two companies are continuing to develop fully integrated power and heating products for the UK market. Investors or media interested in learning more about BlueGen or receiving a demonstration at Ecobuild should contact Ceramic Fuel Cells Limited. www.ecobuild.co.uk/index.html Ceramic Fuel Cells Limited Mark Way +44 7786 116991 About Ceramic Fuel Cells Limited: -- Ceramic Fuel Cells Limited is a world leader in developing fuel cell technology to provide highly efficient and low-emission electricity from widely available natural gas. -- Ceramic Fuel Cells is developing fully integrated power and heating products with leading energy companies E.ON UK in the United Kingdom, GdF Suez in France and EWE in Germany. -- During 2010 EWE placed a conditional order for up to 200 integrated micro CHP products Ceramic Fuel Cells' patented technology. -- Ceramic Fuel Cells Limited has also sold 55 BlueGen gas-to-electricity generators to major utilities and other foundation customers in Germany, the United Kingdom, Switzerland, The Netherlands, Japan, Australia and the USA. -- Ceramic Fuel Cells is listed on the London Stock Exchange AIM market and the Australian Securities Exchange (code CFU). www.cfcl.com.au About E.ON: -- E.ON is one of the UK's leading power and gas companies - generating and distributing electricity, and retailing power and gas - and is part of the E.ON group, one of the world's largest investor-owned power and gas companies. E.ON employs more than 15,000 people in the UK and more than 88,000 worldwide.

THOUSANDS of people in East Yorkshire will be trained to work on wind turbines at the first centre of its kind in the UK

THOUSANDS of people in East Yorkshire will be trained to work on wind turbines at the first centre of its kind in the UK.

The Mail can reveal around 3,000 people a year are expected to be trained in the construction and maintenance of wind turbines at a purpose-built centre in Hull.

The centre will include a 20 metre-high tower to enable learners to get up to speed with climbing huge turbines, offering practical experience for a range of renewables jobs.

This will be complemented by a 25 metre-high training tower on the city's Albert Dock, where prospective employees can also practice working at heights and in confined spaces.

There are also plans to site a turbine tower on the quay side.

Training will be available to anyone looking for a new career, ranging from school and college-leavers to former caravan workers made redundant.

The new training centre is the first tangible proof of the Humber becoming a "super cluster" for the UK's booming renewables industry.

It comes after global energy giant Siemens announced plans to build a huge turbine manufacturing factory in Hull, which is expected to create around 10,000 jobs.

The training centre will open in June and will help provide the workforce for Siemens and other companies.

It is a partnership between Humberside Offshore Training Association (HOTA) and Total Access .

Linda Ellis, general manager at HOTA, said: "This is going to be a unique facility for the wind power industry – not just unique to the region, but to the rest of the country."

The company has invested around £250,000 in the training centre, in Malmo Road, east Hull.

It currently trains around 5,000 people a year in offshore work, such as that on oil rigs.

HOTA expects to train around 3,000 people specifically for the renewable sector every year.

Andrew Dack, managing director of Total Access (UK) Ltd, said: "We are in a strong position to deliver the needs of the renewable energy market from the UK's only purpose-built facility that serves both the marine and land based renewable energy training requirements."

News of the new facility comes just weeks after Siemens announced Hull's Alexandra Dock as the preferred location for its turbine factory.

Mike Sellers, deputy port manager at Associated British Ports (ABP), which owns the dock, said: "This certainly complements the message that the Humber is the ideal location for a renewables super cluster.

"We have always said that Hull and the Humber is the ideal location for firms looking to cash in on the renewables sector.

"Now there is a definite buzz around the place and a positive feel that we can really do this."

HOTA revealed its proposals to the Mail yesterday at a major renewables event at the University of Hull.

The event -Renewing the Humber – was set up to help businesses and investors understand the opportunities in the region's renewables sector and how they could benefit from them.

HOTA had already been in the process of expansion onto a property next to its existing training centre in Malmo Road, where it planned to transfer and expand some of its existing facilities.

The Mail previously reported how Endeavour School, on Beverley Road, could be closed and turned into another training centre for the renewables industry.

The Mail can reveal around 3,000 people a year are expected to be trained in the construction and maintenance of wind turbines at a purpose-built centre in Hull.

The centre will include a 20 metre-high tower to enable learners to get up to speed with climbing huge turbines, offering practical experience for a range of renewables jobs.

This will be complemented by a 25 metre-high training tower on the city's Albert Dock, where prospective employees can also practice working at heights and in confined spaces.

There are also plans to site a turbine tower on the quay side.

Training will be available to anyone looking for a new career, ranging from school and college-leavers to former caravan workers made redundant.

The new training centre is the first tangible proof of the Humber becoming a "super cluster" for the UK's booming renewables industry.

It comes after global energy giant Siemens announced plans to build a huge turbine manufacturing factory in Hull, which is expected to create around 10,000 jobs.

The training centre will open in June and will help provide the workforce for Siemens and other companies.

It is a partnership between Humberside Offshore Training Association (HOTA) and Total Access .

Linda Ellis, general manager at HOTA, said: "This is going to be a unique facility for the wind power industry – not just unique to the region, but to the rest of the country."

The company has invested around £250,000 in the training centre, in Malmo Road, east Hull.

It currently trains around 5,000 people a year in offshore work, such as that on oil rigs.

HOTA expects to train around 3,000 people specifically for the renewable sector every year.

Andrew Dack, managing director of Total Access (UK) Ltd, said: "We are in a strong position to deliver the needs of the renewable energy market from the UK's only purpose-built facility that serves both the marine and land based renewable energy training requirements."

News of the new facility comes just weeks after Siemens announced Hull's Alexandra Dock as the preferred location for its turbine factory.

Mike Sellers, deputy port manager at Associated British Ports (ABP), which owns the dock, said: "This certainly complements the message that the Humber is the ideal location for a renewables super cluster.

"We have always said that Hull and the Humber is the ideal location for firms looking to cash in on the renewables sector.

"Now there is a definite buzz around the place and a positive feel that we can really do this."

HOTA revealed its proposals to the Mail yesterday at a major renewables event at the University of Hull.

The event -Renewing the Humber – was set up to help businesses and investors understand the opportunities in the region's renewables sector and how they could benefit from them.

HOTA had already been in the process of expansion onto a property next to its existing training centre in Malmo Road, where it planned to transfer and expand some of its existing facilities.

The Mail previously reported how Endeavour School, on Beverley Road, could be closed and turned into another training centre for the renewables industry.

Super Angel Fund aims to bring 10 companies to an initial public offering by 2025 has announced its first major investment

A so-called 'super angel fund' which aims to bring 10 companies to an initial public offering by 2025 has announced its first major investment.

Lough Shore Investments in Belfast has given the cash injection to wind energy firm Simple Power, which focuses on generating power from single wind turbines.

A spokesman for Lough Shore, which was founded last year by ex-Wombat chief executive Danny Moore, would not confirm the sum of the investment but revealed it was considerable.

Earlier this month Mr Moore said he wanted to target renewable energy firms, though the fund recently invested in a technology start-up.

Simple Power, which was set up by planning consultant Paul Carson, wants to invest over £50m in Northern Ireland's wind energy market over the next five years.

Ultimately it hopes to help produce more than 50MW of wind energy every year by 2015.

Danny Moore said the venture "ticked all the right boxes" for Lough Shore Investments.

"We want to invest in high potential management teams and partner with them to build great businesses.

"As a first investment, Simple Power could not fit those criteria better. Their management team is second to none, boasting individuals with a proven track record of success both here and abroad

"Their innovative solution is scalable, making it possible to deploy right across the UK, Ireland and mainland Europe. It possesses all the ingredients required to be a great business."

Mr Moore added that Lough Shore would aim to help develop energy possibilities in off-shore wind, biomass and hydro power.

Paul Carson, chief executive of Simple Power, said its business model was built on "dealing openly, honestly and fairly with landowners and farmers".

"They're integral to our business model and we have no doubt this unique approach will make Simple Power the primary renewable energy source in Northern Ireland in the years to come.

"We're delighted to partner with Lough Shore Investments.

"Simple Power is setting out on a journey to harness the vast renewable energy potential that exists in Northern Ireland."

As chief executive of financial software business Wombat, Mr Moore rang the opening bell of the New York Stock Exchange when the firm was bought by NYSE Euronext.

Read more: http://www.belfasttelegraph.co.uk/business/business-news/angel-fund-targets-10-startups-for-ipo-bid-15093377.html#ixzz1EmEVlnqD

Lough Shore Investments in Belfast has given the cash injection to wind energy firm Simple Power, which focuses on generating power from single wind turbines.

A spokesman for Lough Shore, which was founded last year by ex-Wombat chief executive Danny Moore, would not confirm the sum of the investment but revealed it was considerable.

Earlier this month Mr Moore said he wanted to target renewable energy firms, though the fund recently invested in a technology start-up.

Simple Power, which was set up by planning consultant Paul Carson, wants to invest over £50m in Northern Ireland's wind energy market over the next five years.

Ultimately it hopes to help produce more than 50MW of wind energy every year by 2015.

Danny Moore said the venture "ticked all the right boxes" for Lough Shore Investments.

"We want to invest in high potential management teams and partner with them to build great businesses.

"As a first investment, Simple Power could not fit those criteria better. Their management team is second to none, boasting individuals with a proven track record of success both here and abroad

"Their innovative solution is scalable, making it possible to deploy right across the UK, Ireland and mainland Europe. It possesses all the ingredients required to be a great business."

Mr Moore added that Lough Shore would aim to help develop energy possibilities in off-shore wind, biomass and hydro power.

Paul Carson, chief executive of Simple Power, said its business model was built on "dealing openly, honestly and fairly with landowners and farmers".

"They're integral to our business model and we have no doubt this unique approach will make Simple Power the primary renewable energy source in Northern Ireland in the years to come.

"We're delighted to partner with Lough Shore Investments.

"Simple Power is setting out on a journey to harness the vast renewable energy potential that exists in Northern Ireland."

As chief executive of financial software business Wombat, Mr Moore rang the opening bell of the New York Stock Exchange when the firm was bought by NYSE Euronext.

Read more: http://www.belfasttelegraph.co.uk/business/business-news/angel-fund-targets-10-startups-for-ipo-bid-15093377.html#ixzz1EmEVlnqD

Labels:

2025,

aims,

Angel,

companies,

Fund,

initial,

investment,

IPO,

major,

Northern Ireland,

offering,

public,

Super,

technology,

turbine,

wind

Tuesday 22 February 2011

Energy Secretary Chris Huhne praises environmentally-friendly schemes in Bristol

SOME of Bristol's most innovative environmental projects were showcased during a visit by a top Government minister.

A car powered by gas from sewage and £9.4-million plans for a council- owned wind farm in Avonmouth were among the projects showed off to Energy and Climate Change minister Chris Huhne during his tour of the city yesterday.

Mr Huhne said: "Bristol's work to build new industries and jobs around green technologies offers us a glimpse into the future.

"As we face oil prices beyond $100 a barrel and the clearest evidence yet of the physical dangers to the UK of manmade climate change, low carbon is the sure-fire insurance policy with a big economic dividend.

"The city council's plans to build its own wind turbines will generate green electricity and new revenues for the local community."

The Liberal Democrat got behind the wheel of the Bio Bug, a modified Volkswagen Beetle which last year became the UK's first car to run on gas generated from sewage sludge.

Waste recycling company GENeco, which operates the sewage works in Kings Weston Lane, Avonmouth, creates the environmentally-friendly fuel by treating surplus gas.

Mr Huhne also took a look at a plot of council-owned land in Avonmouth which could soon become home to two large wind turbines. If the project takes off, the turbines could generate enough energy to earn the council £1.1 million a year supplying electricity to the National Grid.

Accompanied by city council leader Barbara Janke and councillors Gary Hopkins and Neil Harrison, the minister started his visit at Bristol Port, where he heard from the Bristol Port Company about its new deep-sea container port and plans for offshore renewable industries.

Mr Huhne added: "Bristol Port's plans around offshore wind offer a new future for an established facility. And the bio bug is British innovation at its best. These projects put Bristol ahead of many in seeing the economic and environmental payoffs of shifting to low carbon."

Bristol is one of nine areas receiving funding from the Department of Energy and Climate Change for projects.

Some of the cash will be used to assess all city houses to see whether solar panels can be fitted to them.

In addition, all the city's 34,000 street lights will be updated to be more energy efficient, ten biomass boilers will be fitted in schools and leisure centres and council buildings and schools will also have solar panels installed.

Ms Janke said: "It is very good news that the Energy Secretary is seeing for himself some of our renewable energy projects around the city.

"It is welcome he is taking time to meet with businesses – we have one of the largest environmental technologies sectors in the UK and we want to do all we can to encourage growth and job creation."

A car powered by gas from sewage and £9.4-million plans for a council- owned wind farm in Avonmouth were among the projects showed off to Energy and Climate Change minister Chris Huhne during his tour of the city yesterday.

Mr Huhne said: "Bristol's work to build new industries and jobs around green technologies offers us a glimpse into the future.

"As we face oil prices beyond $100 a barrel and the clearest evidence yet of the physical dangers to the UK of manmade climate change, low carbon is the sure-fire insurance policy with a big economic dividend.

"The city council's plans to build its own wind turbines will generate green electricity and new revenues for the local community."

The Liberal Democrat got behind the wheel of the Bio Bug, a modified Volkswagen Beetle which last year became the UK's first car to run on gas generated from sewage sludge.

Waste recycling company GENeco, which operates the sewage works in Kings Weston Lane, Avonmouth, creates the environmentally-friendly fuel by treating surplus gas.

Mr Huhne also took a look at a plot of council-owned land in Avonmouth which could soon become home to two large wind turbines. If the project takes off, the turbines could generate enough energy to earn the council £1.1 million a year supplying electricity to the National Grid.

Accompanied by city council leader Barbara Janke and councillors Gary Hopkins and Neil Harrison, the minister started his visit at Bristol Port, where he heard from the Bristol Port Company about its new deep-sea container port and plans for offshore renewable industries.

Mr Huhne added: "Bristol Port's plans around offshore wind offer a new future for an established facility. And the bio bug is British innovation at its best. These projects put Bristol ahead of many in seeing the economic and environmental payoffs of shifting to low carbon."

Bristol is one of nine areas receiving funding from the Department of Energy and Climate Change for projects.

Some of the cash will be used to assess all city houses to see whether solar panels can be fitted to them.

In addition, all the city's 34,000 street lights will be updated to be more energy efficient, ten biomass boilers will be fitted in schools and leisure centres and council buildings and schools will also have solar panels installed.

Ms Janke said: "It is very good news that the Energy Secretary is seeing for himself some of our renewable energy projects around the city.

"It is welcome he is taking time to meet with businesses – we have one of the largest environmental technologies sectors in the UK and we want to do all we can to encourage growth and job creation."

Monday 21 February 2011

Ceres commences Wall Hung Fuel Cell Boiler Trial 19th February 2011

Fuel cell manufacturer, Ceres Power Holdings plc has commenced commercial field trials of its wall‐mounted Combined Heat and Power (CHP) boiler in occupied homes.

Following receipt of European type approval, an operating fuel cell CHP product generating heat and power has now been installed in the family home of a British Gas customer in South East England. The field trials programme will continue throughout 2011 and into 2012 with Ceres' CHP products being deployed in a wide range of homes across the UK. In addition, there is an extensive on‐going testing programme of CHP products and components at the Ceres' test facilities.

The first wave of CHP products is being installed in consumers' homes during the first quarter of 2011, with the second wave of products incorporating valuable in‐field experience to follow six months later. The final wave of at least 150 field trial CHP products will take place in 2012 to test the Company's ability to scale‐up for initial product sales and volume launch with British Gas.

The Ceres Power fuel cell CHP product operates on mains natural gas and can generate all of the heating and hot water and the majority of the electricity needs of a typical UK home.

The CHP boilers for the field trials are being manufactured using volume‐capable processes, with the fuel cells at the heart of the product being produced at the Ceres factory in Horsham, whilst CHP boiler assembly is taking place in Holland.

Peter Bance, Chief Executive Officer of Ceres Power, says "We have made enormous progress in the development of our product over the past few months and the start of commercial field trials is a major milestone in Ceres Power's development. I am delighted that our unique wall‐ mounted fuel cell CHP product is now being installed in consumers' homes and look forward to selling the product in conjunction with British Gas."

The field trials are being conducted in partnership with British Gas. Under the contract with Ceres Power, British Gas is paying £5 million to the Company in staged milestone payments and has also placed a forward order to purchase in aggregate a minimum of 37,500 CHP products on an escalating basis. Ceres Power will give an update on its British Gas residential CHP programme at the Company's Interim Results to be presented next month.

Following receipt of European type approval, an operating fuel cell CHP product generating heat and power has now been installed in the family home of a British Gas customer in South East England. The field trials programme will continue throughout 2011 and into 2012 with Ceres' CHP products being deployed in a wide range of homes across the UK. In addition, there is an extensive on‐going testing programme of CHP products and components at the Ceres' test facilities.

The first wave of CHP products is being installed in consumers' homes during the first quarter of 2011, with the second wave of products incorporating valuable in‐field experience to follow six months later. The final wave of at least 150 field trial CHP products will take place in 2012 to test the Company's ability to scale‐up for initial product sales and volume launch with British Gas.

The Ceres Power fuel cell CHP product operates on mains natural gas and can generate all of the heating and hot water and the majority of the electricity needs of a typical UK home.

The CHP boilers for the field trials are being manufactured using volume‐capable processes, with the fuel cells at the heart of the product being produced at the Ceres factory in Horsham, whilst CHP boiler assembly is taking place in Holland.

Peter Bance, Chief Executive Officer of Ceres Power, says "We have made enormous progress in the development of our product over the past few months and the start of commercial field trials is a major milestone in Ceres Power's development. I am delighted that our unique wall‐ mounted fuel cell CHP product is now being installed in consumers' homes and look forward to selling the product in conjunction with British Gas."

The field trials are being conducted in partnership with British Gas. Under the contract with Ceres Power, British Gas is paying £5 million to the Company in staged milestone payments and has also placed a forward order to purchase in aggregate a minimum of 37,500 CHP products on an escalating basis. Ceres Power will give an update on its British Gas residential CHP programme at the Company's Interim Results to be presented next month.

Ultra Electronics acquires portable fuel cell manufacturer Adaptive Materials

U.K.-based Ultra Electronics Holdings has acquired Adaptive Materials, a Michigan-based solid oxide fuel cell developer for $23 million. According to an Adaptive Materials press release, the company will continue to develop and manufacture propane-powered fuel cell systems.

Adaptive Materials designs and manufactures portable fuel cells in the 50-300 W range. Its solid oxide fuel cells run on propane. The company says that propane fuel cells can deliver nine times the energy density of conventional batteries.

2010 appeared to be a good year for Adaptive Materials. Back in March the company won $3 million in new funding through Michigan’s Centers of Energy Excellence Program. In September they were awarded a $750,000 contract to manufacture energy software for the battlefield and received $2.5 million in DARPA funding for portable fuel cells for the U.S. Army. The Army then awarded them $12 million for fuel cell research in November.

Ultra Electronics and Adaptive Materials seems to be a good fit. Ultra Electronics is also a defense company, also focusing on aerospace applications. If things go as planned, Ultra Electronics will offer an additional $5 million to the sale of Adaptive Materials. Certain performance-based measures must be achieved by December 13, 2013 for that bonus to qualify. Lucky number 13?

As a side note, Ultra Electronics says it will keep everyone currently employed at Adaptive, and still hopes to fill the 10 employment positions that Adaptive has open.

Adaptive Materials designs and manufactures portable fuel cells in the 50-300 W range. Its solid oxide fuel cells run on propane. The company says that propane fuel cells can deliver nine times the energy density of conventional batteries.

2010 appeared to be a good year for Adaptive Materials. Back in March the company won $3 million in new funding through Michigan’s Centers of Energy Excellence Program. In September they were awarded a $750,000 contract to manufacture energy software for the battlefield and received $2.5 million in DARPA funding for portable fuel cells for the U.S. Army. The Army then awarded them $12 million for fuel cell research in November.

Ultra Electronics and Adaptive Materials seems to be a good fit. Ultra Electronics is also a defense company, also focusing on aerospace applications. If things go as planned, Ultra Electronics will offer an additional $5 million to the sale of Adaptive Materials. Certain performance-based measures must be achieved by December 13, 2013 for that bonus to qualify. Lucky number 13?

As a side note, Ultra Electronics says it will keep everyone currently employed at Adaptive, and still hopes to fill the 10 employment positions that Adaptive has open.

UK Feed in Tariff (FIT's) for Ceramic Fuel Cells Bluegen MCHP

UK Feed in Tariff

During the half-year (2010) the Company continued to make progress towards having BlueGen certified under the Microgeneration Certification Scheme (“MCS”) in order to access the UK Government’s feed in tariff. All microgeneration products must be accredited under MCS in order to be eligible for the UK feed in tariff.

In the December quarter a new MCS standard for electricity led micro combined heat and power units was developed, approved and published. Ceramic Fuel Cells was

instrumental in instigating and promoting this new standard which is an essential

requirement for accreditation under MCS. The existing standards applied to micro heat and power products which maximised heat output. This new standard applies specifically to micro heat and power products whose primary purpose is to generate electricity, with domestic hot water being an additional output. During the December quarter the Company also successfully completed a range of tests required by the MCS.

BlueGen was successfully tested under the PAS67 standard - the British Standards

Institution standard for tests to determine the heating and electrical performance of microcogeneration packages. This testing confirmed that BlueGen provides hot water for domestic use as well as significantly reducing net carbon emissions when compared to a modern condensing gas boiler and electricity from the UK grid. BlueGen was also tested by an independent body for its noise output.

In December the MCS auditor, BRE Global, conducted a factory assessment at Ceramic

Fuel Cells’ production facility in Melbourne. The Company expects the review of the data provided during this site visit to be completed during the March quarter, and additional procedures to be implemented during the June quarter in order for BlueGen to be formally accredited under MCS.

During the half-year (2010) the Company continued to make progress towards having BlueGen certified under the Microgeneration Certification Scheme (“MCS”) in order to access the UK Government’s feed in tariff. All microgeneration products must be accredited under MCS in order to be eligible for the UK feed in tariff.

In the December quarter a new MCS standard for electricity led micro combined heat and power units was developed, approved and published. Ceramic Fuel Cells was

instrumental in instigating and promoting this new standard which is an essential

requirement for accreditation under MCS. The existing standards applied to micro heat and power products which maximised heat output. This new standard applies specifically to micro heat and power products whose primary purpose is to generate electricity, with domestic hot water being an additional output. During the December quarter the Company also successfully completed a range of tests required by the MCS.

BlueGen was successfully tested under the PAS67 standard - the British Standards

Institution standard for tests to determine the heating and electrical performance of microcogeneration packages. This testing confirmed that BlueGen provides hot water for domestic use as well as significantly reducing net carbon emissions when compared to a modern condensing gas boiler and electricity from the UK grid. BlueGen was also tested by an independent body for its noise output.

In December the MCS auditor, BRE Global, conducted a factory assessment at Ceramic

Fuel Cells’ production facility in Melbourne. The Company expects the review of the data provided during this site visit to be completed during the March quarter, and additional procedures to be implemented during the June quarter in order for BlueGen to be formally accredited under MCS.

Ceramic Fuel Cells Limited Highlights Of 2010

Financing Activities

In August 2010 the Company undertook a placement of 95.3m shares at a price of 10.5 pence (approximately 18.25 Australian cents) and raised the equivalent of AUD 17.4m. In September 2010 the Company made an offer to shareholders on the same terms and issued a further 70.3m shares and raised an additional AUD 12.8m. The net amount raised from both fundraising rounds after transaction costs was AUD 28.9m. During the half-year the Company’s investment in inventory has increased from AUD 1.1m in June 2010 to AUD 4.9m at December 2010. This increase will be directed to fulfilling the existing order backlog and to meet expected future sales.

Operational Overview

Ceramic Fuel Cells Limited is a leader in developing solid oxide fuel cell technology to provide highly efficient and low-emission electricity from widely available natural gas (and other hydrocarbon fuels in the future). A fuel cell is an electricity generator that converts gas into electricity and heat through an electrochemical reaction, without combustion or noise. Fuel cells can provide significant environmental benefits through high efficiency and low emissions.

Global energy markets are facing a transformation. Peak demand for energy is rising, requiring significant investment in new power generation and grid infrastructure. However there is widespread agreement that greenhouse gas emissions from electricity generation must be reduced. These forces create a very large global opportunity for low-emission energy technology, like solid oxide fuel cells, which can be deployed using the existing natural gas and electricity infrastructure. These market forces also encourage a move away from large centralised power stations towards ‘distributed generation’, where small scale power stations are installed close to where the power is used, with no transmission losses.

Ceramic Fuel Cells’ products have achieved electrical efficiency of 60 percent at the point of use, which the Directors believe is higher than any other electricity generating technology. When heat is recovered from the electricity production process, total efficiency is up to 85 percent – twice as efficient as the average among current European power stations.

This very high efficiency can significantly cut carbon emissions from power generation. There is now widespread recognition that maximising electrical efficiency is the key to creating the most value from small scale power and heating products, and the Directors believe the Company’s achievements can create a strong competitive advantage in this very large global market.

Customers and Products

The first products powered by the Company’s fuel cells are small scale units for homes and other buildings that produce up to two kilowatts of electricity as well as heat for hot water or space heating. In order to cater for different markets and customers, the Company is developing two products in parallel: integrated combined heat and power (mCHP) units, as well as a modular generator product called BlueGen. Both products use the Company’s Gennex fuel cell module and share many ‘balance of plant’ components, allowing the Company and its partners to create different products and customer offerings from the same core technology platform.

Integrated mCHP – Power + Heating + Hot Water

During the half-year the Company continued to develop fully integrated mCHP products with its European utility and appliance partners, including EWE AG in Germany, E.ON in the United Kingdom and GDF SUEZ in France. In these partnerships, Ceramic Fuel Cells supplies its Gennex fuel cell modules to appliance partners, which integrate them with high efficiency boilers into single integrated units to convert natural gas into power, hot water and space heating for homes. The appliance manufacturer or the utility then sells or leases the mCHP unit to the homeowner.

The highlight of the half-year was the Company securing a conditional order in December 2010 for up to 200 integrated mCHP products from German energy service provider EWE. This is the largest order the Company has received, with total revenue of up to EUR 4.9 million over two years. EWE will install the units in homes in the Lower Saxony region in northern Germany. EWE is one of the largest utilities in Germany, with 6,400 staff and revenues of EUR 5.8 billion. Based in Northern Germany, EWE also has operations in other German states as well as Poland and Turkey.

The order is conditional on EWE receiving partial funding under the German

government’s national hydrogen and fuel cell technology innovation program. This

Government program is providing EUR 700 million between 2008 and 2018. EWE has

submitted a formal funding application and a positive decision is expected in early 2011. Subject to EWE obtaining Government funding and to the units meeting agreed performance targets, EWE will order 70 units for delivery in 2011 and 130 units for delivery in 2012. The performance targets, unit prices and the rates for ongoing service and support have been agreed in a contract signed by EWE and the Company.

This is a significant follow-on order from EWE, the Company’s longest standing utility customer. The Directors are confident that the German government will support the project and we look forward to updating shareholders in due course. Apart from Germany, during the half-year the Company continued to operate integrated power and heating units in the United Kingdom and France. In the United Kingdom, the Company is in discussions with its utility partner E.ON UK to

finalise the details of the next stage of product deployment. In February 2009 the Company and E.ON agreed the profile of a future volume order for mCHP units. Subject to the Company meeting agreed price and performance targets, E.ON UK will place a minimum order of 100,000 units from 2012-2018 in order to retain exclusivity for Ceramic Fuel Cells’ mCHP products in the UK market.

In France the Company is working with GDF SUEZ, one of the world’s largest diversified energy utilities and the dominant gas utility in France (with 11 million customers in France). The Company has successfully built and operated integrated units with GDF SUEZ and its appliance partner De Dietrich Thermique (now part of the BDR Thermea group). In December 2010 the partners agreed to the next stage of the product rollout, in which Ceramic Fuel Cells and BDR Thermea will build the next generation of product for testing by GDF SUEZ. This version of the product will use the same core Ceramic Fuel Cells components, which BDR Thermea will tightly integrate with a high efficiency boiler into a physically smaller unit.

BlueGen sales – Power + Hot Water

Apart from the integrated product, the Company has also developed a modular power and heat generator called BlueGen, to provide low emission power plus heat for hot water. One BlueGen can provide about double the electricity the average home needs – excess power can be exported to the grid – plus hot water for an average family’s needs. Like the integrated product, BlueGen uses the Company’s Gennex fuel cell module to achieve electrical efficiency of 60 percent – far higher than any other small scale electricity generator.

During the half-year the Company continued to receive orders for BlueGen units from leading energy companies and other foundation customers. To date the Company has received orders for 63 BlueGen units, from customers in Germany, Switzerland, the United Kingdom, The Netherlands, Italy, Japan, Australia and the USA. A total of 21 BlueGen units are installed and operating in customers’ sites.

Highlights during the half-year and up to date include:

The Company has sold its first BlueGen units in Italy, to leading energy company Edison S.p.A. Edison will install one BlueGen unit at its test laboratory and then at its headquarters in Milan, and will install two further units with customers when modifications to the unit’s power management system are completed to comply with Italian grid requirements. Edison is one of Italy’s leading electricity and gas companies, with 2009 revenues of EUR 9 billion.

In December the Company sold three BlueGen units to E.ON UK. One BlueGen will be